SEE THE SIGNALS

The amount of data available for analysis is becoming increasingly vast. More than ever, investors are looking for ways to cut through the noise.

In order to succeed, firms must first identify new ways to examine the market from multiple perspectives. By providing research from the macro to the micro, NDR provides a more complete investment picture.

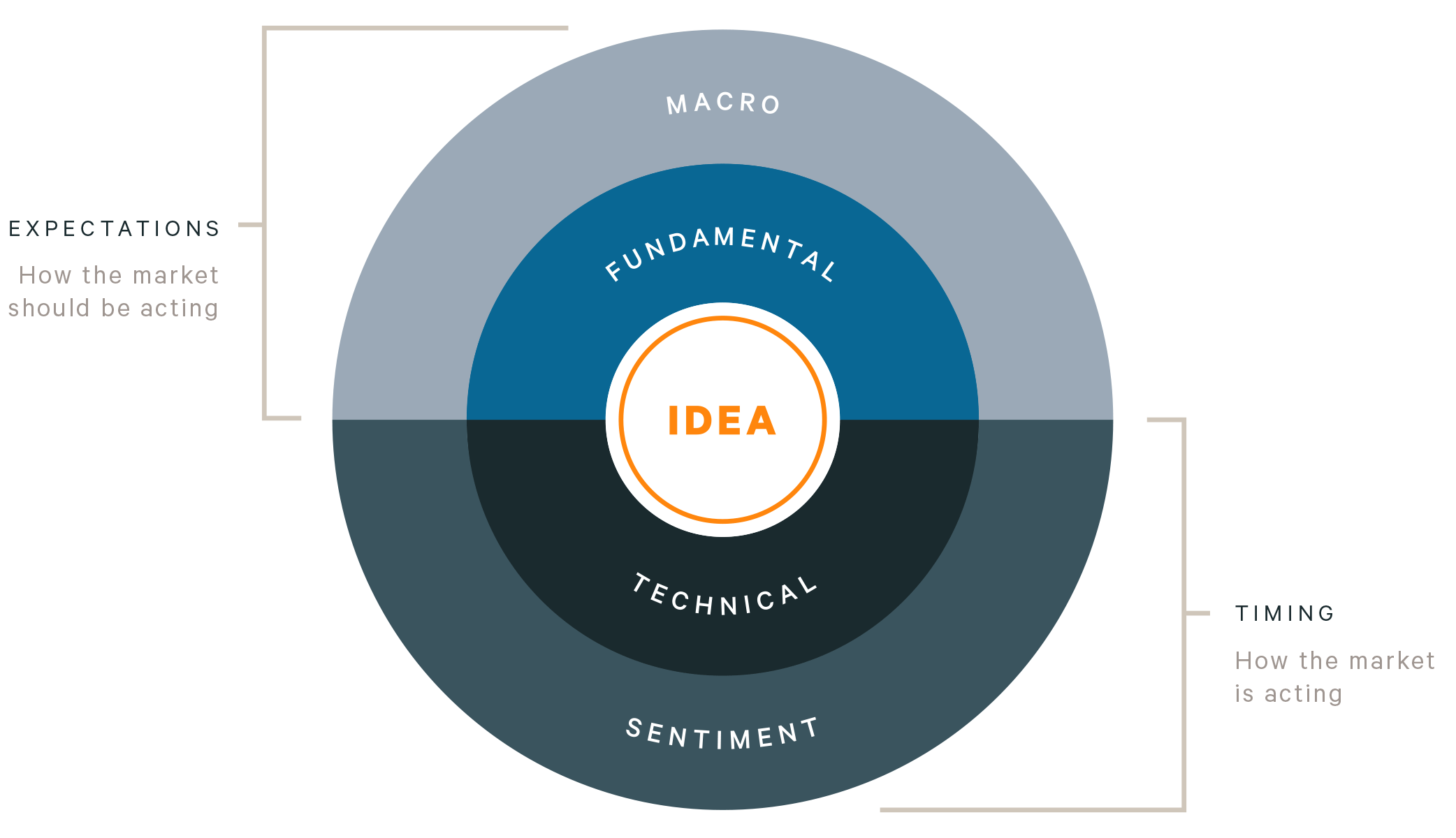

OUR 360º APPROACH

Our approach combines both fundamental and technical research disciplines.

Fundamentals tell us how the markets should be acting while technicals reveal how the markets are acting. Truly insightful and timely ideas demand a balance between these two disciplines. Actionable ideas meet balanced, strategic insights through our 360-degree methodology.

Complimentary Research

NDR Long Term Capital Market Assumptions

January 2025

2025 Outlook

December 2024

OUR INSTITUTIONAL OFFERING

Institutional

Market StrategyRobust global investment strategy, beginning with a macroeconomic foundation and extending into the major asset classes and geographies.

ThemesThe NDR thematic Opportunities product provides high-conviction investment ideas for investment managers and their clients.

Selection: Stocks & ETFsNDR’s Stock & ETF Selection service provides global objective analysis, screening, and implementation ideas for commonly traded stocks and ETFs.

AlternativesNDR provides research and investment ideas for key areas of the alternatives space, including Commodities, Real Estate, and Cryptocurrencies.

Custom Research SolutionsNDR Custom Research Solutions focuses on customized, objective research based on extensive quantitative analysis and models.

Who we serve

Asset ManagerAsset managers will benefit from NDR’s broad spectrum of geographic and asset class coverage, from economics all the way down to specific industries and themes.

Asset OwnerComplimentary access to summary investment insights, client communication resources, and investment ideas including model portfolios.

Hedge FundHedge funds and active managers with the ability to quickly trade a diverse universe of assets will benefit from NDR’s spectrum of coverage, from global macroeconomic down to specific asset-class themes and instruments.

OUR WEALTH OFFERING

Wealth

Market StrategyResearch for small-to-mid size advisors/wealth managers that provides market insights, select indicators and reports covering economics and investment strategy.

Model PortfoliosPortfolios include global tactical asset allocation, equity and fixed income sector rotation, and thematic and factor-based stock strategies.

Who we serve

Business DeveloperNDR offers complimentary access to summary investment insights, client communication resources, and investment ideas including model portfolios.

Investment ManagerResearch for small-to-mid size advisors/wealth managers that provides market insights, select indicators and reports covering economics and investment strategy.