See the signals.

NDR's robust investment research publications, charts, model portfolios, and 360-degree approach have been cultivated over the last 45 years to help you "See the signals."

About Us

Ned Davis Research (NDR) is a global provider of independent investment research, solutions and tools. Founded in 1980, NDR helps clients around the world make objective investment decisions. Our experienced strategists and analysts use fundamental and technical research with models, charts, indicators and weight-of-the-evidence methodology to help clients see the signals and invest with confidence. NDR is headquartered in Sarasota, Florida with offices in New York and London.

NDR's 360° Approach

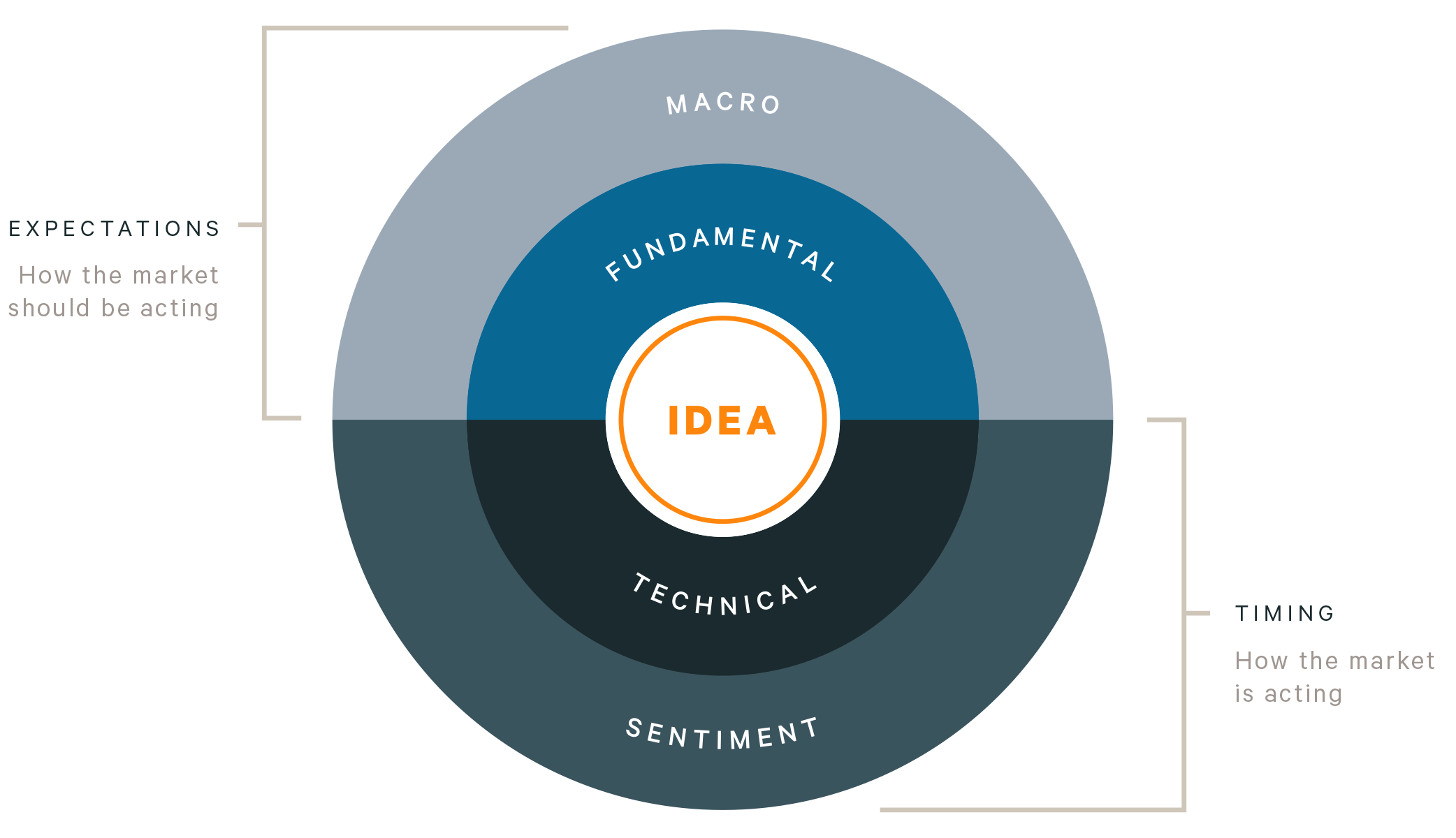

Our approach combines both fundamental and technical research disciplines. Fundamentals tell us how the markets should be acting while technicals reveal how the markets are acting. Truly insightful and timely ideas demand a balance between these two disciplines. Actionable ideas meet balanced, strategic insights through our 360-degree methodology.

We believe that successful investing is seeing the signals and avoiding mistakes. To do this, you need a clear view of the whole investment picture, which must include a perspective on Sentiment.

What we mean when we say: See the signals.™

The amount of data available for analysis is becoming increasingly vast. More than ever, investors are looking for ways to cut through the noise. In order to succeed, firms must first identify new ways to examine the market from multiple perspectives. By providing research from the macro to the micro, NDR provides a more complete investment picture.

Register for a Trial

Explore NDR's 360-degree approach to leverage insights that combine how the market should be acting with how the market is acting.

The NDR Approach

NDR sat down with MarketFox to describe how we approach multi-asset portfolios, asset allocation, and the rules of research.

Listen to the Full Interview

Our Clients

We serve a broad range of clients across an array of industries:

Long-Only Portfolio Managers

Portfolio Managers use NDR's models as a confirmation/challenge to research analysts' recommendations. They also find the timely cyclical work to be of use, e.g. dividend payer valuations, earnings vs economic cycles, etc.

Long-Only Sector Analysts

Complementary to their own bottom-up research, sector analysts stay informed with technicals on their particular sector/industry. Also adding depth is NDR's macroeconomic analysis of headwinds/tailwinds for specific sectors.

Pensions/Endowments

NDR's economic & strategy research provide backdrops for allocation decisions.

Hedge Funds

NDR's research gives hedge fund managers a key source of ideas, themes and macro inputs both from a discretionary and systematic viewpoint. Custom research services often provide bespoke market, asset, stock, and scenario analysis as well.

Private Banks/Wealth Managers

NDR is used as an important internal asset allocation and macro risk input, as well as a proven independent source of charts and perspectives to enhance advice and recommendations to clients.

Strategists/Economists

Interest spans across all areas. From economic and bond research….to global equity and asset allocation… to regional strategy… to sector analysis.

Advisors

Advisors find value in NDR's stock and ETF models, asset allocation research, and sector research.

Marketing Teams

The broad thematic work, visual charts and hundreds of vetted data sources provide resources to marketing teams for their own white papers and corporate marketing material.